Why Aave’s Fee Distribution Plan Is a Win for Holders

[ad_1]

Aave, a decentralized finance (DeFi) lending protocol, is contemplating activating a “fee switch” to incentivize participation and investment within its ecosystem

Marc Zeller, the founder of the Aave Chan Initiative, revealed this strategic move during a recent discussion on social media platform X.

Aave Contemplates Fee Switch

Zeller said the platform’s decentralized autonomous organization (DAO) currently earns approximately $60 million annually in net profits. This substantial figure provides “runway [for] half a decade” as it significantly dwarfs the platform’s operational costs of $12 million. Consequently, Zeller announced an impending “temp check to activate a ‘fee switch’ next week.”

A fee switch, in essence, empowers a platform to toggle specific user fees on or off. For Aave, this means the potential redistribution of transaction-generated fees to platform participants, particularly Aave holders and stakers.

Zeller had previously alluded to implementing fees for Aave stakers in March. At the time, he suggested that a revamped safety module would advocate for fee distribution to stakers.

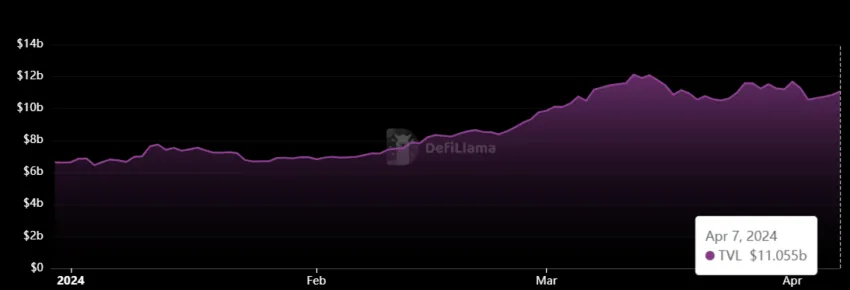

On-chain data from DeFiLlama shows that Aave is the largest lending protocol in the industry, with over $11 billion worth of digital assets locked on it, while the Aave treasury currently commands $50.3 million across ten addresses. Following news of the proposed fee switch, the price of AAVE rose 4% to around $120.

Read more: Aave (AAVE) Price Prediction 2024/2025/2030

While Aave gears up for this move, it is worth noting that it is not the first DeFi protocol to adopt a fee switch. Frax Finance governance recently sanctioned a proposal reintroducing a fee switch, and decentralized exchange Uniswap is on the verge of finalizing its own fee switch proposal.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Recently, the Aave DAO has been abuzz with numerous proposals concerning its operations. One prominent proposal, currently under scrutiny, revolves around curtailing exposure to DAI after MakerDAO announced its intention to invest up to $1 billion in fast-rising USDe synthetic dollar stablecoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link